The art and financial worlds coincided this week with the news that Patrick Drahi, the new owner of Sotheby’s, has brought in art world ingenue Charles Stewart as CEO. Stewart replaces Tad Smith who after just a few years on the job was himself still considered an ingenue. It is not surprising that Drahi would bring in his own management team, with Stewart for the preceding few years the CEO of a media company also owned by Drahi. According to a news release issued by Sotheby’s, Tad Smith will stay on as ‘senior adviser’ to Charles Stewart.

In her New York Times article, Robin Pogrebin cites an analysis of Sotheby’s sale and management changes by Marc Porter, chairman of Christie’s America. Per Porter, given the $3.7 billion Drahi paid for Sotheby’s and the placement of a telecommunications executive as its new CEO, Drahi must be positioning management strategically in an attempt to achieve a return on investment more commensurate with a tech company (read ‘higher than’) what would be expected from a fine art auction house. Well, yes, but as the company is now privately held, one can only assume.

Drahi himself is a collector and at the time the sale of Sotheby’s was announced, there was some expression of opinion that in some oblique way, ownership of Sotheby’s would enhance his collecting activities. A number of years ago, something similar was said when Bernie Osher, a wealthy collector of American paintings, purchased old line San Francisco auction house Butterfield’s. That didn’t prevent Osher from selling at a premium a few years later to eBay. I think there’s very little doubt that Drahi with his appointment of Charles Stewart expects a significant amount of value added to his Sotheby’s purchase. What changes and how profitability and the inherent value of the company is enhanced are at this point a matter of speculation. Suffice to say, given the premium price paid by Drahi, Stewart has his work cut out for him.

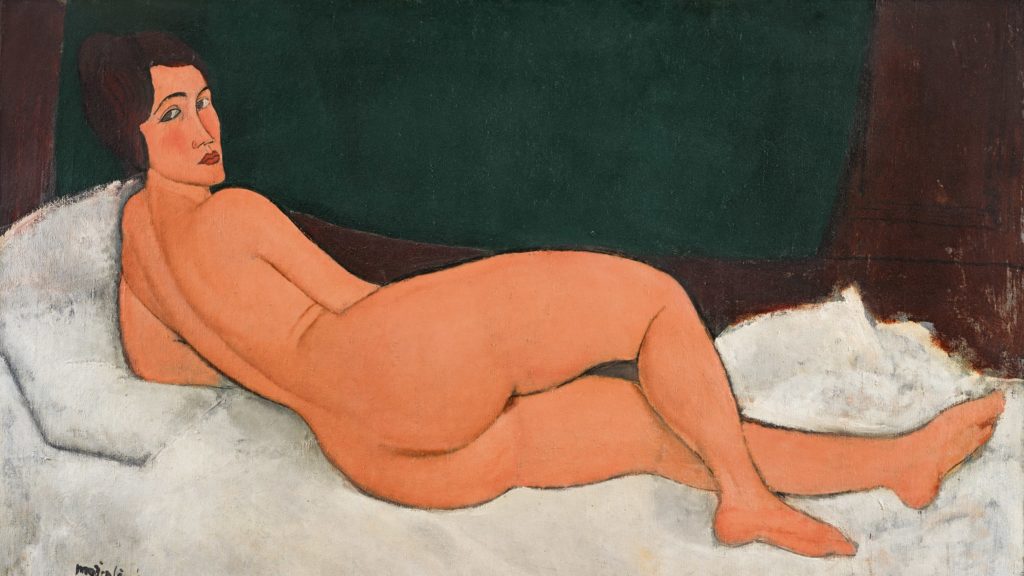

And that work must be herculean. When Drahi offered $57 per share on June 17, Sotheby’s share closing price the day before was $35.39. Drahi’s offer of a 61% premium becomes mystifying when one considers the company’s dramatic swings in income and revenue. Indeed, along with Christie’s, it has for years been dependent on the next big auction sale. And along with Christie’s, has offered enormous blandishments to prospective consigners including inordinately optimistic presale estimates, cut rate buyer’s premiums, and huge advances against the sale of consigned lots. At the time of Drahi’s offer, Sotheby’s had just posted a loss for the preceding quarter and an overall decline in revenue compared to the same period the preceding year. According to The Art Newspaper, a significant portion of the loss was thought to be related to the failure of two consigned lots- Modigliani’s Nu couche and Picasso’s Buste de femme– to cover the amount of the minimum consignor payout guaranteed by Sotheby’s.

Sotheby’s under Tad Smith has cast about for sources of revenue, presumably to even out the peaks and valleys of its financial performance. Along with Christie’s, it increased its number of online only sales, and it also launched an online retail platform for the sale of vintage merchandise. And, along with Christie’s, and Bonhams, too, shed a number of departmental positions within the auction house.

With all that, Sotheby’s core auction house business is under tremendous competitive pressure, and not just from traditional rival Christie’s. Bonhams, itself purchased by a private equity firm earlier in the year, has ramped up its online and marketing presence, and worldwide, every little hamlet and crossroads that was home to a local auction house now has a worldwide reach. To name one of a number, Jersey-based technology company Webreality does a burgeoning business solely to design and support the online presence of fine arts auctioneers. As well, a number of auction platforms, including The Saleroom, Invaluable, and LiveAuctioneers provide a global presence for even the smallest auction houses. While Christie’s and Sotheby’s and smaller rival Bonhams have long offered sales through their own online platforms, now Bonhams feels the need to broaden its reach, just announcing it will offer sales through The Saleroom. Given the stampede toward online sales, paradoxically Sotheby’s spent a reported $55 million earlier this year to enhance the physical plant of its New York saleroom.

Everything about Sotheby’s financially checkered recent past does now beg innumerable questions about its prospects for the future, to say nothing about the why of its acquisition. But, as the press release issued at the time of Drahi’s offer in June makes clear, taking the company private provides greater opportunity for flexibility and change, without public disclosure to shareholders. So, privately held as it now is, I suppose we’ll only have to wait and see.